Overview of Legal Practitioners Trust Accounts

Trust accounts by definition are bank accounts specially designed for registered legal practitioners managing or holding funds in trust on behalf of clients or third parties. The purpose of a trust account is to safeguard and protect client’s funds. It is regulated by section 86 of the Legal Practice Act No. 28 of 2014.

The funds contained in this account are not owned by the principal client (the Legal Practitioner) as they are only controlled by virtue of a fiduciary relationship for the third party/client of the Legal Practitioner.

A trust account legal practitioner must be in possession of a Fidelity Fund Certificate (FFC) issued by the Legal Practice Council, which must indicate that the legal practitioner concerned is obliged to practice subject to the Act (s 84(1) and (4)).

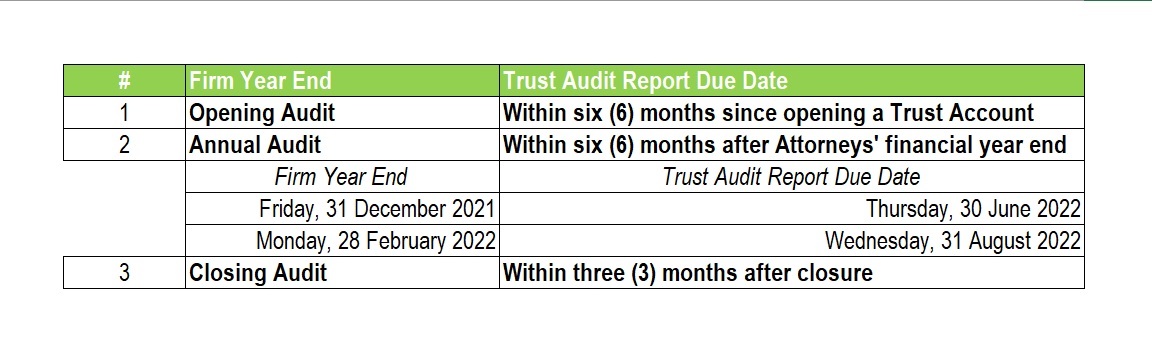

Legal practitioners are bound by a strict professional code of conduct as prescribed by their regulatory body, and include the transparent management of clients’ trust accounts which are subjected to regular audits by registered auditors.