Overview of Attorneys’ Trust Accounts

Every estate agent shall open and keep one or more separate trust accounts, which shall contain a reference to this section, with a bank and such estate agent or his or her employee, as the case may be, shall forthwith deposit therein all trust money held or received by or on behalf of such estate agent and the name of such bank and the number of each such trust account shall forthwith be notified to the board.

Any estate agent may invest in a separate savings or other interest-bearing account opened by him with any bank, building society or any institution or class of institution designated by notice in the Gazette by the Minister in consultation with the Minister of Finance, any monies deposited in his trust account which are not immediately required for any particular purpose.

Every estate agent shall keep separate accounting records of all monies deposited by him in his trust account and of all monies invested by him in any savings or other interest-bearing account.

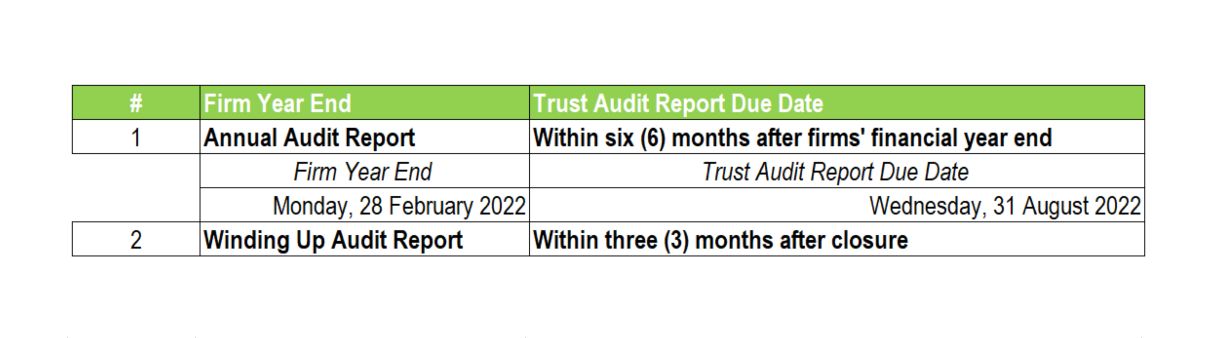

Any auditor who does an audit shall forthwith after completing such audit, transmit to the board a report in the form from time to time determined by the board, in regard to his findings, and a copy thereof to the relevant estate agent.